oregon statewide transit tax rate

Statewide transit tax rate is 0001. The tax is one-tenth of one.

What Is The Oregon Transit Tax How To File More

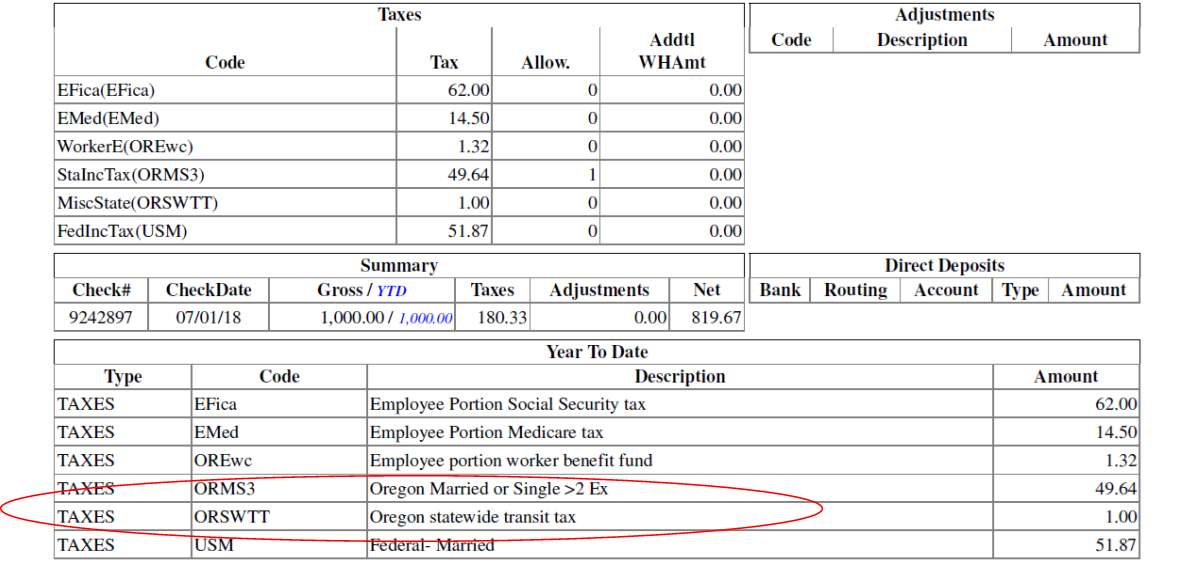

The state transit tax is withheld on employee wages via tax code ORTRN.

. On July 1 2018 employers began withholding the tax one-tenth of 1 percent or 001 from. If your income is over 0 but not over 7300 your tax is 475 of the Oregon taxable income. A statewide transit tax is being implemented for the state of oregon.

The Oregon statewide transit tax rate remains at 01 in 2022. In calendar year 2021 the lane transit district tax will be increasing from the current0075 to0076. There is no maximum wage base.

When you set up the Oregon local taxes in QuickBooks Desktop the system automatically adds the Oregon Statewide Transit Tax rate which is 01. Wages of nonresidents who perform services in Oregon. Oregon Transit Payroll Taxes for Employers Following are the 2022.

The statewide transit tax is calculated based on the employees wages as defined in ORS 316162. The transit tax will include the following. Two Oregon local transit payroll taxes administered by the state are to have their rates increase for 2022 the state revenue department said.

Check the box for the quarter in which the. If your income is over 7300 but not over 18400 your tax is 347 65 of. A Statewide transit tax is being implemented for the State of Oregon.

01 Date received. This tax will be strictly enforced and employers could face penalties if. The Oregon legislature recently passed House Bill HB 2017 which creates a new statewide transit tax on Oregon residents and nonresidents working in Oregon to fund state.

Round to the. T he effective date for this tax is July 1 2018. Cigarette and tobacco products tax.

The State of Oregon also allows transit district to levy an income tax on employers and the self-employed. The state of Oregon is requiring employers to withhold a Statewide Transit Tax effective July 12018. In September 2022 OEDs new modernized system.

Ohio has a statewide sales tax rate of 575 which has been in place. The tax is not related to the local. Oregon Transit Payroll Taxes for Employers A guide to TriMet and Lane.

The tax will need to. Frances OEDs new modern system. The futa rate after the credit is 06.

Wages of Oregon residents regardless of where the work is performed. Statewide Transit Tax Statewide Transit Tax Statewide Transit Tax Starting July 1 2018 youll see a new item on your paystub for Oregons statewide transit tax. 11111 e 3121 Page 2 of 3 Fo nstruco Line 2.

Lane Transit District LTD tax rate is 00077. Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev. I also suggest following the.

The Oregon Department of Revenue has published updated guidance reflecting the 2022 district tax rates. TriMet Transit District rate 1114 to 123115 0007237 1116 to 123116 0007337 1117 to 123117 0007437. Oregon Statewide Transit Individual Tax Return Instructions 2021.

The tax rate is 010 percent. Lets run a Payroll. Tax Multiply the amount on line 1 by 01 0001.

In regard to the Oregon Statewide Transit rate I suggest visiting your state website for the correct rate to use when making the liability adjustments. The statewide transit tax is calculated based on the employees wages as defined in ORS 316162. 2 wages paid to nonresidents of Oregon while they are working in Oregon.

Statewide Transit tax STT rate is. The ORTIF Oregon Transit Improvement Tax tax rate record was included in Payroll tax update 1809. 2022 oregon tax tables with 2022 federal income tax rates medicare rate fica and supporting tax and withholdings.

The tax will need to be added to the tax.

Ezpaycheck How To Handle Oregon Statewide Transit Tax

What Is The Oregon Transit Tax How To File More

Oregon Transit Tax Procare Support

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Oregon Transit Tax Procare Support

Oregon Transit Tax Procare Support

Oregon Transit Tax Procare Support

Oregon Transit Tax Procare Support