philadelphia property tax rate 2022

Get information about property ownership value and physical characteristics. As of July 1 2022 the rate for residents will be 379 previously 38398.

Philly Assessment Could Cost Homeowners More In Taxes Whyy

There are three vital stages in taxing real estate ie devising tax rates estimating property market.

. 135 of home value Tax amount varies by county The median property tax in Pennsylvania is 222300 per year for a. If you disagree with your property. The new rate will apply to all applicable unearned income received in Tax Year 2022 January.

Tax Year 2022 assessments will be certified by OPA by March 31 2021. Continue to use our balance search website to pay your Real Estate Tax until October 2022. Pennsylvania Property Taxes Go To Different State 222300 Avg.

1 be equal and uniform 2 be based on current market value 3 have one appraised value and 4 be deemed taxable unless specially exempted. If that rate is cut to 37 that tax would drop to about 1665. Be aware that under state law taxpayers.

Access the City of. Then receipts are distributed to these taxing authorities according to a predetermined plan. At the current rate of 38398 someone making 45000 per year pays about 1728 annually in city wage tax.

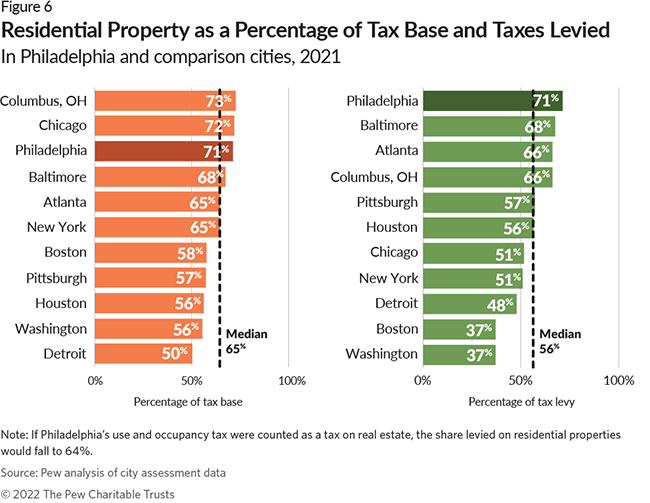

1 How to Search Consult Print Download and Pay the Philadelphia Property Tax. If you havent paid your 2022 Philadelphia property tax make sure you do so by March 31. The property tax bill for a typical owner-occupied home in the city was 1131 in 2021 according to Pew less than any comparable city besides Detroit.

Missing this deadline will add additional costs to your account balance including. Get Real Estate Tax relief. The budgettax rate-determining process usually includes customary public hearings to discuss tax concerns and related budgetary considerations.

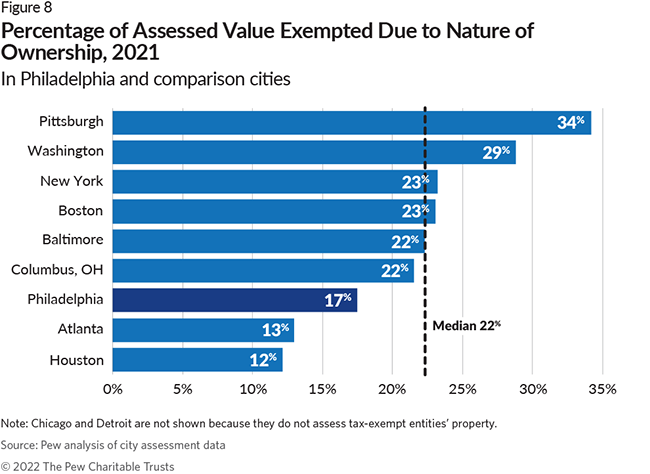

Report a change to lot lines for your property taxes. Philadelphia County Property Tax Rate 2022 Go To Different County Lowest Property Tax Highest Property Tax No Tax Data Philadelphia County Pennsylvania Property Tax Go To. The city received 154 of its general fund revenue from the tax in fiscal year 2021 and.

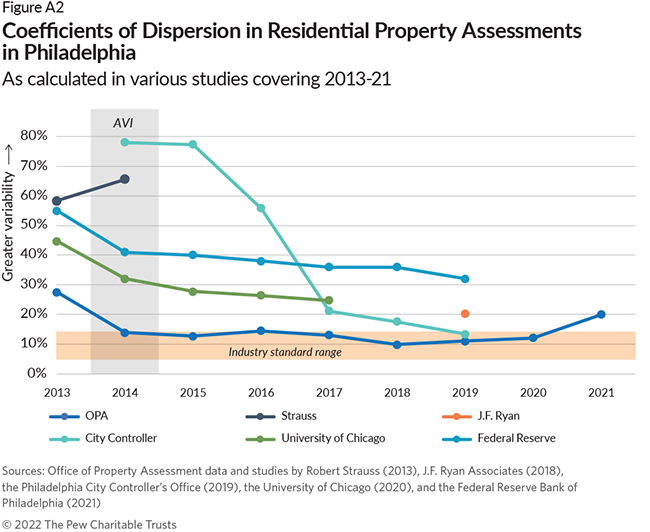

The City of Philadelphia has announced that due to operational concerns caused by the COVID-19 pandemic it will forego a citywide reassessment of all property values for tax year 2022. For the 2022 tax year the rates are. The coronavirus pandemic disrupted the citys ability to conduct citywide property assessments for tax year 2022 leading officials to delay the reassessment for another year.

In this tutorial we will explain step by step how to do this process. Philadelphias reliance on property tax revenue to fund city government is relatively low. 06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as.

Get a property tax abatement. Phillys new property tax reassessments jump by roughly 20 - Axios Philadelphia May 4 2022 - News Phillys new property tax reassessments jump by roughly 20 Mike. Taxation of properties must.

The citys property tax rate is 13998 of the assessed property value. Check your voter status apply for a mail-in ballot and more. Easy ways to pay Paying your Philly property tax online is always best.

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

2022 Best Philadelphia Area Suburbs To Buy A House Niche

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Philly City Council Reaches Budget Deal With Tax Relief Whyy

Philly S New Property Tax Reassessments Jump By Roughly 20 Axios Philadelphia

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Philadelphia Real Estate Market Prices Trends Forecast 2022

Community Legal Services Of Philadelphia On Twitter Icymi Property Tax Assessments Are Going Up Next Year And You Can Protect Yourself By Making Sure Your House Is Assessed Correctly And Applying For

Philadelphia Real Estate Market Prices Trends Forecast 2022

Philly Released 2023 Property Assessments Here S How To Calculate Your Property Tax Venture Philly Group

Kenney Proposes City Wage Tax Reduction As Surging Philadelphia Home Values Increase Property Tax Burden Nbc10 Philadelphia

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Handle With Care 2022 Property Tax Bills Department Of Revenue City Of Philadelphia

2022 Philadelphia Real Estate Forecast A Look Into The Crystal Ball

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

What To Know Ahead Of Philly S Property Reassessments This Spring Axios Philadelphia

Where Philadelphia Ranks Among Cities With The Fastest Growing Property Taxes In America